On Friday, the Nasdaq Composite posted its best day in more than five months, with a 2% rally that pushed this Index further into an uptrend. The S&P 500 had a good day as well, with all eleven sectors advancing higher. The sharp advance was led by a pronounced move into Growth stocks led by the Magnificent Seven, which each outperformed the broader markets. The growth-heavy Technology sector was the top-performing, followed by Communication Services and Consumer Discretionary.

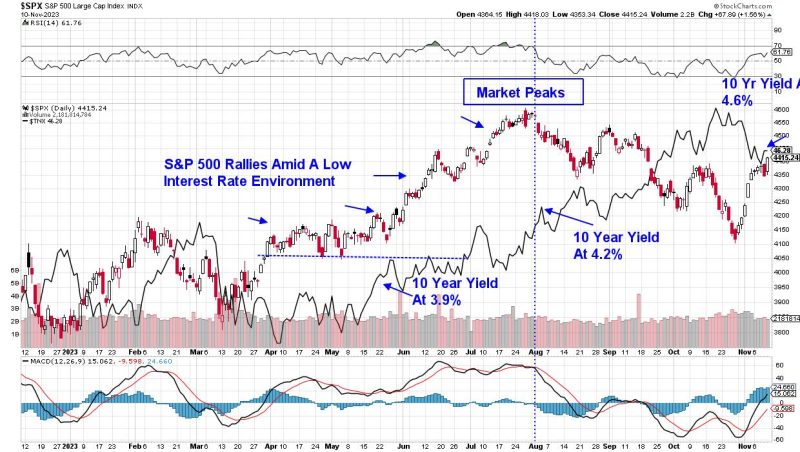

As you may know, growth stocks are highly sensitive to interest rates, as they fare poorly in a rising rate environment due to the value of their future earnings being reduced. Last week, we saw interest rates pull back early on and remain steady. This was despite hawkish comments from Fed Chair Powell on Thursday that followed similar remarks from several Fed Governors this week. Below is a chart of the S&P 500 Index, with the yield on the 10-year Treasury bond overlaid on top.

Daily Chart of S&P 500 with 10-Year Treasury Yield

Of note on the chart above is that the market’s May-into-late-July rally took place when the yield on the 10-year Treasury was in the 3.9%-4.2% range. We’re not quite in that sweet spot range at this time, but last week’s stabilization of rates, despite Fed comments that point to the possibility of a higher-for-longer rate policy, was constructive. You’ll want to keep a close eye on yields before jumping totally into these markets.

In addition to lower interest rates, another key to a prolonged uptrend in the markets will be broader participation beyond the Magnificent Seven and other Technology stocks. Below is a chart of the equal-weighted S&P 500 Index, with the Vanguard Growth ETF (VUG) overlaid on top.

Equal-Weighted S&P 500 Index with Vanguard Growth ETF

As you can see, the May-into-late-July rally this year was given a considerable boost by a broadening out into other areas, as can be seen by the uptrend in the equal-weighted S&P 500. Gains in Industrials (XLI), Basic Materials (XLB), and Energy (XLE) sectors — to name just a few areas — created a firmer footing beyond just Growth. Last week, the equal-weight S&P 500 fell 0.6%.

While last week’s rally in the markets keeps the near-term uptrend in place, I’m on the lookout for further confirmation that this uptrend has legs. Next week, key inflation data will be released, with core CPI and PPI reports due. Any hints of an increase will not be good for the markets. That said, there are clear-cut, long-term winners that have revealed themselves over the past 3 weeks, and venturing into them makes sense. If you’d like to be alerted to these stocks, as well as to any long-term bullish sentiment shift for the markets, use this link here to take a trial of my twice-weekly MEM Edge Report.

Warmly,

Mary Ellen McGonagle

MEM Investment Research