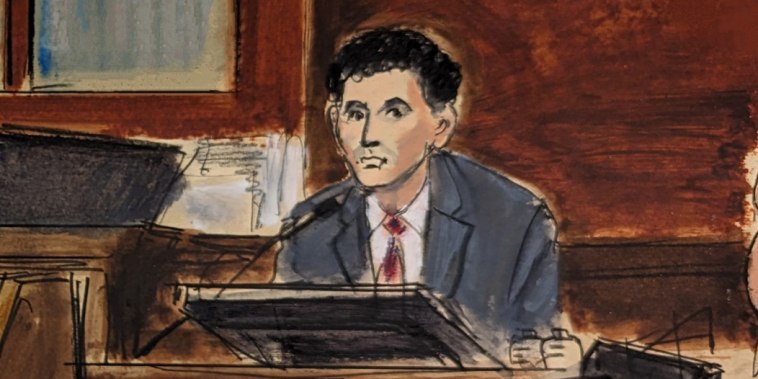

Prosecutors cross-examined FTX co-founder Sam Bankman-Fried on Monday after the former crypto billionaire testified in his own defense.

Bankman-Fried is facing decades in prison on seven federal charges, including wire fraud, securities fraud and money laundering. He has pleaded not guilty to all charges.

The trial is expected to conclude in the next few days.

Several times during cross-examination Monday, prosecutors asked Bankman-Fried questions, then displayed exhibits that disputed his answers.

In one instance, Assistant U.S. Attorney Danielle Sassoon asked Bankman-Fried if he had assured people that Alameda Research played by the same rules as others on the FTX exchange. Bankman-Fried said he was not sure he had done so.

The government then showed a tweet where he had directly addressed the topic, then an email where he wrote that the account of Alameda Research, FTX’s ‘sister’ hedge fund, was like everyone else’s.

FTX co-founder Gary Wang and senior executive Nishad Singh both testified that Alameda was allowed to have a negative balance and a $65 billion line of credit with FTX.

Bankman-Fried completed his testimony for the defense earlier in the day. In that testimony, he tried to rebut charges that were levied against him by FTX insiders like Wang, Singh and former Alameda CEO Caroline Ellison.

For example, Bankman-Fried testified he did not go to the Middle East in October 2022 to raise funds to fill holes in FTX’s balance sheet. He said he viewed Alameda and FTX as solvent and made the trip to speak at a conference and meet with investors, regulators and employees.

He was also asked about a now-infamous, and since deleted, tweet he sent last Nov. 7: ‘FTX is fine. Assets are fine.’

Bankman-Fried said that at the time, he thought that Alameda had some $10 billion in assets and that FTX’s balance sheet was fine.

‘My view was the exchange was OK and there was no holes in the assets,’ he told the court.

However, customers began withdrawing their money faster and faster after some of Alameda’s financial liabilities and its close ties to FTX became public.

Alameda’s assets were cut in half as digital currencies plunged in value. FTX didn’t have enough assets available to handle the $4 billion in daily withdrawals.

Bankman-Fried testified that the hedge trades the firm had used to protect itself from market downturns did not work. He testified earlier that Ellison did not follow instructions to hedge some of its bets. He also testified that he realized on Nov. 8, 2022, that Alameda Research would have to be shut down.

Both FTX and Alameda filed for bankruptcy on Nov. 11.

Bankman-Fried is scheduled to face additional charges at a separate trial in March and has also pleaded not guilty to those allegations.